Writing Project 3

Arshia Parvaz Writ 340 - Tomkins November 2, 2023

Part I

Introduction

It is no secret that the performance of real estate today could be better. Whether it be investing, purchasing, or renting, all players within the real estate space are being negatively affected in some way. Numerous factors explain how and why real estate has reached such lows. This informative essay will aim to explain the different events that brought us here today with real estate, how the market reacted to these events, and what to expect looking forward.

The average real estate cycle is 18 years. These 18 years include a recovery phase, an expansion phase, and a recession phase. It is well-known that 2008 had been the most previous real estate crash: the end of a cycle. The recessionary phase is approximated to be year 14 of the 18-year cycle, making 2022 the expected year for a decrease in sale velocity. However, an unexpected global event sped up this process: COVID-19.

COVID-19: Impact of Unemployment Rate on Real Estate

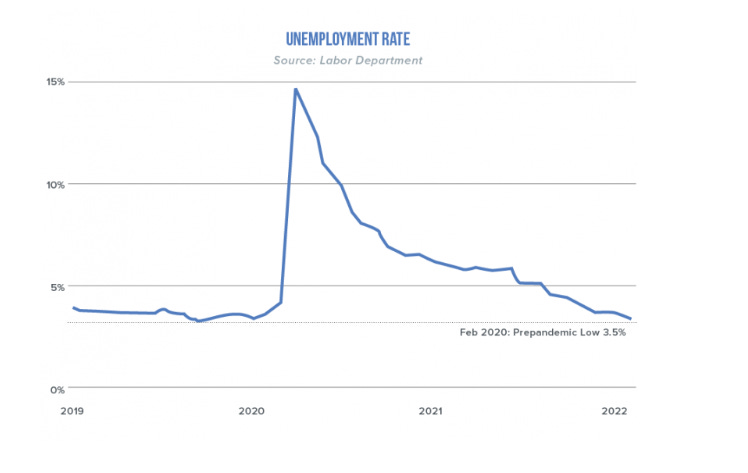

The impact of COVID-19 affected nearly every economic sector in the United States. Only about a month into the pandemic, in April 2020, the unemployment rate spiked to 14.7%, the highest since the Great Depression in the 1930s. It had been estimated that in October 2021, there were 4.2 million fewer jobs than pre-pandemic. Low-wage jobs consisted of a majority of these job losses, making it even more difficult for low-income people to accumulate their savings and put down a viable down payment. This results in the overall demand for housing to decrease, ultimately bringing down home prices.

Well, how might unemployment affect commercial real estate prices? The real estate sector that was affected by the pandemic the most was office space. As the unemployment rate increases, companies will have fewer employees, resulting in a decrease in the need for office space, commercial buildings, and industrial space. For any business, the most expensive part of their operating expenses will be rent. Suppose there are fewer employees in offices and other commercial spaces. In that case, the first thing that comes to mind when cutting costs is how to reduce rental expenses, whether it be downsizing the current operating space or removing that space altogether.

Another sector that was heavily affected is hospitality. During the pandemic, all tourism and travel were put on a halt. The hospitality industry took a big hit from this, where vacancies in hotels went through the roof. Many development projects in this sector were delayed or even scrapped due to future uncertainty. However, hospitality and leisure have recovered the most after the pandemic, contributing to the most job growth; accounting for 1 in 4 new jobs in the United States.

COVID-19: Impact on Employee Productivity

The debate on employee productivity has been a particularly prominent trend within tech industries. Studies show that employees in this industry working from home have a noticeable increase in their productivity. When analyzing the situation from a tech firm's perspective, it is a no-brainer to eliminate office space altogether and have their employees completely work from home. It has only been until recently that controversies arose about how accurate the studies have been when measuring productivity. However, this heavily depends on the sector; It makes much more sense for coders and analysts to do their work from home than real estate agents and stock brokers. For example, Amazon, one of the largest companies in the world, maintains its stance on remote work and has completely integrated its AWS sub-sector as remote.

Commercial Real Estate and Interest Rates

The rise of remote work has ultimately decreased the demand for office space as well as increased both maintenance costs and interest rates. Currently, commercial real estate sale volume is about a fourth of what it previously was, with prices declining as much as 40%. These commercial properties are taking a big hit due to the Federal Reserve’s aggressive campaign regarding the expense of financing. Right now, mortgage rates for a typical 30-year amortization period are a little above 8%, a 22-year high. The reason the interest rate is so high is because the Fed is attempting to reduce the inflation rate, which they have been successful in doing so. The inflation rate in the first quarter of 2022 was about 9%, whereas today it is similar to the unemployment rate at 3.7%.

A high interest rate is also unfavorable for borrowers as acquiring a loan for a home, a car, or a business is more expensive. This is the main reason why commercial real estate sale velocity is so low right now. Companies that want to physically implement their firm within an office building or that want to store their products in warehouses will be met with much higher costs of loan acquisition than before, making it oftentimes less viable, resulting in a big hit to the economy overall. New developments have slowed down tremendously as well, given construction loans and other costs have spiked, making potential investments more arduous in turning a profit.

Commercial Real Estate and U.S. Treasury Bonds

Recent news emerged that U.S. Treasury Bonds reached a high since 2007. Right now treasury bonds surpassed a 5% yield. This means that the Fed wants more money to flow into the bond market than the stock market in an attempt to battle soaring inflation rates. Bonds are the main competitors of the stock market. So when the bond market yield increases, equities in the stock market will often go down. These bonds are backed by the U.S. government whereas stocks are not, making them a safer investment.

So how does an increased yield in U.S. Treasury Bonds affect real estate? A given principle when investing in the stock market is often comparing your investment to that of the S&P 500 which is about 8%. Investors are looking to beat the S&P 500 to ensure a good investment. A similar situation is attributed to real estate. Real estate developers and investors often compare their IRRs (internal rate of return) to that of the 10-year treasury. A common notion of a good investment is to have your investment be at least 2-3% greater than the bond market. As the yield for the bond market increases, the IRR for these projects has to increase accordingly for a viable investment. To put it into simple terms. Let’s assume you have $1,000,000 to invest. You can either choose to invest in a real estate project or investment property that will yield 5% with associated risks or you can invest your money into the bond market for a guaranteed return of 5%. The most optimal choice is to invest the money into U.S. Treasury Bonds, as it is the safer investment for the same return. Let’s say the U.S. Treasury Bond yield is at 3.5%, what it normally is. A real estate investment with a projected IRR of 6% sounds great, as you are beating the U.S. Treasury by 2.5%, making the investment worthwhile. Now given the current climate, your investment will still give you a return of 6%, but the U.S. Treasury Yield is now 5%. This would make you reconsider your investment, which many real estate investors have started doing this past month.

An increase in the bond yield will also increase property cap rates. A cap rate is a percentage attributed to a given commercial real estate property that tells an investor the risk and reward associated with purchasing the property. The percentage is calculated by dividing a property's NOI (Net Operating Income) by its market value. Similar to the IRR, the cap rate regards the return the investor will receive. The main difference, however, is that a cap rate is a snapshot of the property at a specific moment in time, while the IRR provides an overall view of the total returns on an annualized basis. For example, a McDonald’s in downtown Los Angeles will have a lower cap rate (lower risk) than a McDonald’s in Nebraska. The risk associated with the downtown Los Angeles property is lower for the investor, however, the return will also be lower as well. High risk equals high reward. Now the reason this is important is because the current interest rate of 8% has increased the cap rates of all commercial real estate properties by a significant amount (about 150 basis points), to the point where investments that once made sense no longer pencil. This makes investing in commercial real estate more difficult, overall decreasing the sale volume of revenue-generating properties.

What to Expect in the Future

As previously mentioned, real estate is a cyclical business. The highs will not always be highs and the lows will not always be lows. Right now we are experiencing a trough within the market. Demand is low and supply is high. It is not until the Fed lowers the interest rates that demand will continue to rise again. Experts believe that the interest rate will not return to prepandemic numbers anytime soon. A 6% interest rate that had once been considered very high, will likely become the new norm. Industries, developers, and investors will have to better strategize their investments to better adapt to this new norm of loan acquisition. The United States is run on capitalism. And with capitalism comes business, new ideas, and other ventures that all tie into real estate one way or another. The rumors that commercial real estate is dead are nonsense. Although the industry is taking a hit currently, it will inevitably come back strong, whether it be a year from now, a couple of years, or longer.

Many professionals in this field are considering this time to be a waiting period. Investors and developers are waiting and analyzing the market to identify moments of economic opportunity to continue or begin their projects. The market will need to readjust and adapt for sale volume to increase again. This is a time of great uncertainty, but many real estate gurus and company leaders are optimistic about the future of commercial real estate and company performance. However, it is important to be optimistic in these types of situations as new opportunities for innovation and modernization may arise. Office space landlords are extremely uncertain during these times and don’t know where to turn. Although their fears are warranted, it is important to understand that office space and its demand will not go anywhere. We are simply in a time of technological adjustment that will require new modes of integration. Commercial real estate will continue to be strong in the future and individuals devoted to the industry should be excited to experience what comes next.

Works Cited

Chen, James. “Capitalization Rate: Cap Rate Defined with Formula and Examples.” Investopedia, Investopedia, www.investopedia.com/terms/c/capitalizationrate.asp.

Goodkind, Nicole. “Why Are Treasury Yields So High and What Does It Mean for You? | CNN Business.” CNN, Cable News Network, 18 Aug. 2023, www.cnn.com/2023/08/18/investing/premarket-stocks-trading/index.html.

Lake, Rebecca. “What Is the IRR for Real Estate Investments?” SmartAsset, SmartAsset, 16 Nov. 2022, smartasset.com/investing/internal-rate-of-return-real-estate-investments.

Tracking the COVID-19 Economy’s Effects on Food, Housing, And ..., www.cbpp.org/research/poverty-and-inequality/tracking-the-covid-19-economys-effects-on-food-housing-and. Accessed 3 Nov. 2023.

“United States Inflation Rate.” Trading Economics, tradingeconomics.com/united-states/inflation-cpi.

Valencia, Lori. “How the Unemployment Rate Is Affecting CRE.” Matthews, 30 Sept. 2022, www.matthews.com/unemployment-rate-affecting-cre/.

2023 Commercial Real Estate Leaders Outlook, 17 Jan. 2023, www.jpmorgan.com/insights/outlook/business-leaders-outlook/commercial-real-estate-business-leaders-outlook#:~:text=Almost%20half%20of%20real%20estate,expect%20a%20recession%20in%202023.

Part II

I decided to write an informative piece on this subject because it allows the reader to get a firm grasp of important economic aspects that are impacting real estate and the economy as a whole today. I believe that there can never be enough informative essays regarding this topic because it is constantly changing. Whether it be interest rates, inflation, unemployment, or bond yield, I find it important to constantly cover these topics on a fundamental basis to allow all types of readers to fully understand the concepts.

I find informative essays to be better suited for me at this moment as my expertise in the subject is not at a level that could credit opinionated essays. I understand that I am currently a college student with almost no real-world experience in commercial real estate. I would be doing a disservice to readers who could potentially take my opinions as fact, as I can oftentimes be incorrect or misinformed in different areas. I have not yet reached the confidence and expertise I require to support opinionated essays at this moment.

With the essay, I am more comfortable presenting already known information conducted by experts than conducting my own research. I formatted the essay into different sections to allow the reader to comfortably switch topics when reading. I sectioned the essay based on the different aspects of what has been affecting commercial real estate. I refrained from implementing my beliefs and focused on stating facts.

The intended audience for my essay consists of individuals who are not savvy in real estate but have some interest in learning more about the industry. Whether these people just want to read up on the topic or start investing themselves, I framed the essay in a way that presents data in a digestible manner without overwhelming information. I made sure to utilize easy-to-understand language and further explain definitions that are specific to real estate. I was also specific with my tone. I wanted the essay to read like a conversation with a less formal demeanor. I find articles like these to be more enjoyable and easier to read. For me, it is accommodating for me to retain the information if it is presented this way because it allows me to think deeper about the concepts discussed rather than how the sentences are constructed.

Although it is somewhat rudimentary to understand concepts such as inflation, interest rates, and unemployment, it is not common knowledge how these factors affect real estate. I wanted to make it easy for the reader to understand how these concepts individually affect real estate so they can utilize what they learned in conversations about real estate that they may have not been able to contribute to otherwise.

I can certainly see an issue with readers more advanced on the subject who think the essay is too rudimentary. However, the goal of my paper is to not elevate the knowledge of already knowledgeable readers but to rather present new knowledge to readers who are not familiar with the subject but have expressed interest.

The reason I chose to target this specific audience is because of my first-hand experiences with talking to friends and family. Being a real-estate major, there are many conversations I have had where the other person expresses interest in real estate but doesn’t know where to begin. When trying to explain different concepts about the details of real estate sometimes they get lost. I believe it is important to understand these concepts and how they are attributed to real estate before diving into the industry head first. Once a reader can understand the fundamental mechanics between the Fed’s policies and real estate, they can then begin reading more about the details of real estate investing. Imagine a person wanting to invest in real estate doing hours of research to buy their first investment property all to realize that the current interest rate makes their investment plans unfeasible. This is why I believe it is crucial to understand these concepts first.

The range of audiences writers typically use this genre to address is not very vast. Writers on this subject assume that because the reader is actively looking for information on real estate, they already have some real estate investing experience or are attributed to real estate professionally when that is often not the case. It is important to be accommodating to all different types of expertise. I think there should be a greater number of articles that focus on educating the youth on real estate. It is not a topic covered in high school, yet some high schoolers may have an interest in the field. If they come across the wrong article and are met with specific language and complex ideas, it may turn them away from pursuing real estate in the future.